nebraska sales tax rate on vehicles

With local taxes the total sales tax rate is. Registering a new 2020 Ford F-150 XL in Omaha.

States With No Sales Tax On Cars

Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to 15.

. There are no changes to local sales and use tax rates that are effective July 1 2022. Waste Reduction and Recycling Fee. Municipal governments in Nebraska are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 0825 for a total of 6325 when combined with the state sales tax.

Sales and Use Taxes. Motor Fuels Taxes and Vehicle Registration Fees. Sales Tax Rate Finder.

50 - Emergency Medical System Operation Fund - this fee is collected for Health and Human Services. The Nebraska state sales and use tax rate is 55. This is less than 1 of the value of the motor vehicle.

State Sales Tax 184718. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. Counties and cities in Nebraska are allowed to charge an additional local sales tax on.

In most states you pay sales tax on the monthly lease payment not the price of the car. Enter zip code of the sale location or the sales tax rate in percent Sales Tax. There are a total of 334 local tax.

The Nebraska state sales and use tax rate is 55 055. The Nebraska sales tax on cars is 5. The Nebraska state sales and use tax rate is 55 055.

You must pay sales tax when you lease a car. In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees. The Nebraska NE state sales tax rate is currently 55.

Additional fees collected and their distribution for every motor vehicle registration issued are. 200 - Department of Motor Vehicles Cash Fund - this fee stays with DMV. FilePay Your Return.

Any sales tax collected on sales and short-term leases of motor vehicles that is in excess of 5. This is because the first bracket is fairly wide 0 - 3999 and has only a 25 tax when new. Sarpy County Courthouse Campus 1210 Golden Gate Drive Papillion NE 68046 402-593-2100 Sarpy County 1102 Building 1102 E.

Sales tax must be paid on all new or used vehicles within the first 30 days following the purchase in order to prevent a. You can find these fees further down on the page. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt.

Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. In addition local sales and use taxes can be set at 05 1 15 175 or 2 as adopted by city or county governments. There are no changes to local sales and use tax rates that are effective January 1 2022.

Nebraska has a statewide sales tax rate of 55 which has been in place since 1967. This example vehicle is a passenger truck registered in Omaha purchased for 33585. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2.

150 - State Recreation Road Fund - this fee. Subsequent brackets increase the tax 10 to. MOTOR FUELS TAXES AND VEHICLE.

Money from this sales tax goes towards a whole host of state-funded projects and programs. 536 rows Nebraska Sales Tax55. 31 rows The state sales tax rate in Nebraska is 5500.

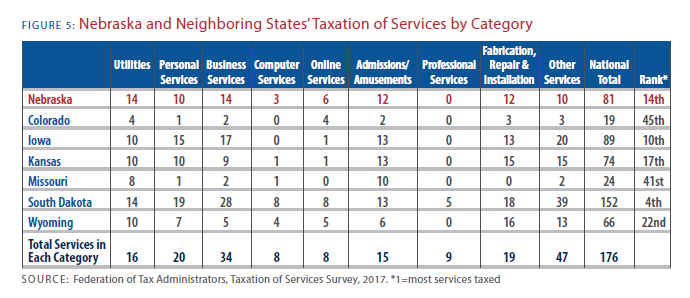

With local taxes the total sales tax rate is between 5500 and 8000. Taxes in Nebraska Sources of Major State and Local Taxes Motor Vehicles DATA. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

Sales tax for a leased vehicle is calculated based on the. The cost to register your car in the state. 1st Street Papillion NE 68046.

Nebraska Sales Tax Small Business Guide Truic

Nebraska Auto Taxes And Fees To Watch Out For Woodhouse Nissan

What S The Car Sales Tax In Each State Find The Best Car Price

What S The Car Sales Tax In Each State Find The Best Car Price

Sales Tax On Cars And Vehicles In Florida

Nebraska Auto Taxes And Fees To Watch Out For Woodhouse Nissan

States With No Sales Tax On Cars

Sales Tax On Cars And Vehicles In Nebraska

What S The Car Sales Tax In Each State Find The Best Car Price

States With Highest And Lowest Sales Tax Rates

Vehicle Sales Tax Deduction H R Block

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Car Tax By State Usa Manual Car Sales Tax Calculator

Form 6 Fillable Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales 8 2012